Continuing from my first post on the Christian case against Bitcoin and blockchain, this post looks at the technology claim – the idea that Bitcoin, Ethereum and other cryptoassets represent an amazing “technological revolution” that we should be making the most of.

This post got out of hand, despite cutting tons of material! But, in my defence:

It’s shorter than Dan Olson’s 2 hour marathon, Line Goes Up (very highly recommended).

It has a contents table, so you can skip to the bits that interest you.

It has GIFs. A few.

The problem with technology

Crypto-mania is not really about technology. If you want to understand what is going on, you need to understand it at the level of economics, culture and human nature, which I touched on more in my first post, and Dan Olson’s video is excellent in that regard.

The technology is just a source of “magic”. In other places and times, the witch doctor, or the priest speaking in Latin, provided the magic that you couldn’t speak against. In our day, it is the high priests of science and technology [1]. But they can be much more convincing than voodoo, because science and technology actually work.

And computer technology can appear quite magical. Modern hardware seems nearly miraculous, and there have been amazing software breakthroughs, especially in the area of cryptography – such as public key cryptography and Diffie-Helman key exchange — that are not only mathematical gems, but amazingly useful too.

And no-one wants to be Paul Krugman in 1998:

So, this post is an attempt to equip those who aren’t computer experts with enough knowledge to engage with the main technological claims of blockchains, and how they measure up in reality. I won’t go into mathematical detail, and I will obviously simplify in some cases, but try not to make any simplifications that mislead.

Evaluating technology

How do you evaluate a piece of technology? In the many Open Source projects and closed source private projects I’m involved in, when a change or addition is proposed, the questions you ask are:

What problem does this try to solve?

Does it actually solve it?

What costs does it bring with it?

So let’s look at those questions regarding Bitcoin, Ethereum etc.

What problem does Bitcoin solve?

We can’t do better than to refer to the original Bitcoin whitepaper, which describes a “A Peer-to-Peer Electronic Cash System”.

The fundamental problem Bitcoin claims to solve is the ability to have “peer-to-peer” electronic money transfers that do not go through a financial institution, in a similar way to how cash works peer-to-peer, without needing a trusted third party to be involved. In the whitepaper, the primary motivations for this are:

to avoid the need to trust intermediaries,

to reduce transaction costs by reducing costs associated with mediation (banks have to be ready to sort out cases of fraud),

to deal with fraud caused by reversible transactions.

So, in evaluating Bitcoin, we should primarily be comparing it to other payment systems – physical cash and electronic payments – and banking systems.

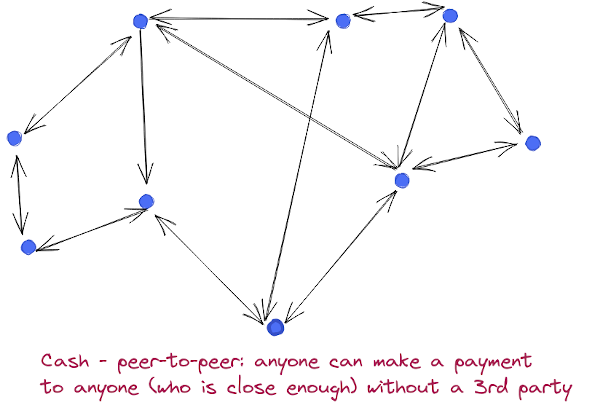

Cash is a convenient form of payment that takes seconds to complete, is highly reliable, and has a very high degree of privacy. It suffers from the inconvenience and insecurity of having to carry cash around with you, and so is increasingly being replaced by electronic transfers. These work extremely well:

In a shop, I can pay for goods electronically with a PIN or just a swipe, taking a few seconds to complete a transaction, using a bank debit card or a credit card.

-

Between friends, I can do instant (or almost instant), free bank transfers 24/7 for small to fairly large amounts, and with other slower systems for very large amounts. When I lived in Turkey, I had the same – though inter-bank transfers cost a few pennies – and as far as I can tell most countries have something similar right now.

In countries that are lagging in this regard (hello USA!), there are other solutions like Venmo that apparently work pretty well.

-

This convenience brings some security issues, but modern banking has tons of great features for handling fraudulent activity – for example:

Got a call this morning about unusual credit card charges. Within ten minutes had the card cancelled, all the ongoing fraudulent charges blocked, all the older fraudulent charges disputed, and a new card in the mail.

There is some significant room for improvement:

You need a bank account to do these electronic transfers.

Banks are capable of blocking financial activity, which can be bad if it is legitimate and you are being persecuted in some way.

There is the risk of banks going bust.

Banks, or other third parties that we route payment through, have a pretty clear idea of how we are spending money.

Banks are not perfect, but they are fairly well regulated, and of all the financial worries I have, banks stealing or losing my money is the least of them. Even if they go bust I have a government protection guarantee of £85,000 in the UK. In evaluating cryptoassets, we need to see how much they can actually improve things, if at all.

How the blockchain solution works

The innovation that permissionless blockchains [2] have brought is an ingenious consensus algorithm based on “proof of work”. Let’s unpack that briefly (or, just skip this bit, I won’t tell anyone).

Consensus protocols are mechanisms for allowing a group of cooperating computers (usually called nodes) to act as a single database and store data safely and consistently even if:

there is no fixed leader among the nodes

any of the nodes may become faulty or unavailable at any time.

Designing protocols to do this is really challenging, but there are good options today, all with some limitations.

Bitcoin goes one step further, allowing consensus to be achieved under even more challenging circumstances, including when there are any number of unknown nodes who may join in, and they may all be actively trying to cheat each other.

Proof of work was a pre-existing concept. It is based on the fact that some computations require a lot of work to do, but are easy to verify once done. The output of such computations can be used as proof that you’ve spent computational resources (i.e. electricity), and therefore the money it requires.

Bitcoin uses “proof of work” in a novel way as a consensus protocol by making cheating too expensive. It essentially requires computers to make many, many guesses for the next “right” number that would allow a proposed new transaction to be added to the end of a list. The result is that a distributed set of nodes who don’t trust each other can achieve agreement on a growing chain of records, called blocks, that list transactions, i.e. transfers of Bitcoin. The protocol does this without requiring a central trusted authority (like a government), or a trusted intermediary (like a bank), and without allowing bad actors to transfer the same money to more than one person (a problem known as “double spending”).

The electricity required for this deliberately inefficient process has to be paid for, of course, so why would anyone join in? Bitcoin solves this as follows:

the protocol rewards any participant that correctly adds a block to the chain with some newly created Bitcoin.

in the real world, we need a sufficient number of people to believe this Bitcoin is worth something, rather than merely being a made up token on a computer. Otherwise “miners” have spent a lot of electricity for nothing.

Does this solution actually work?

Most people agree that the fundamental mechanics of blockchains as a consensus protocol, as described in the Bitcoin whitepaper, do actually work.

However, the solution has immense weaknesses and costs.

Problems and costs

Peer-to-peer?

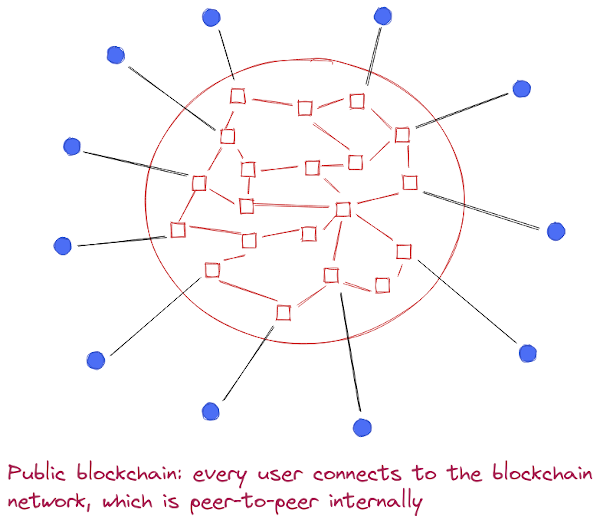

While technically the shape of Bitcoin network can be described as “peer-to-peer” in terms of the participating computers, from the perspective of users making payments it is not.

Normally, peer-to-peer internet protocols only require the involvement of the two peers to succeed [3]. In the real world, cash is a genuine peer-to-peer protocol – no-one else needs to be involved at all for a cash transaction to work.

Bitcoin is very different. If I have some Bitcoin, and want to transfer it to you, and we are both sitting in the same room and have all the computer and network hardware we like, it is still impossible for me to transfer ownership to you without an internet connection. We have to connect to the Bitcoin network, add our transaction to the public, shared list of all transactions, and wait for confirmation. So, from the perspective of a user wanting to make a payment, it’s better to think of Bitcoin as a large, distributed but centralised system rather than a decentralised one.

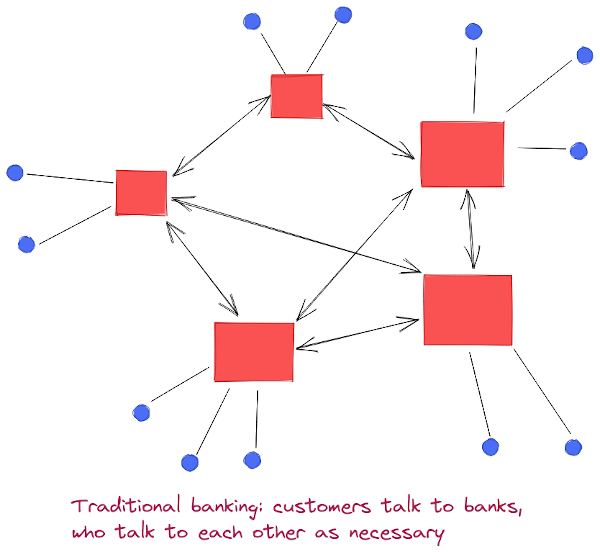

This is in contrast to electronic transfers in traditional banking. If you and I have the same bank, we only need to talk to our bank in order to transfer money between us, and no outside network needs to be involved. If we have different banks, they need to be able to talk to each other, but that is all.

There is no shared ledger of transactions that needs to be communicated between banks and kept consistent, and this is a crucial advantage. This makes Bitcoin, at its theoretical best, more centralised and less peer-to-peer than traditional banking (at least in theory [4]).

Security

There are significant ways cryptocoins could fail disastrously. The first of these is “network partition” events.

The question is this: what happens when part of the network becomes cut off from the rest? For example, one country might become disconnected, or the whole of the Americas might become disconnected from Europe, Asia and Africa.

With the modern internet, it’s most likely that this would be the result of some kind of cyber-attack, but it could also happen accidentally.

Now, some might suggest that such a partition is far-fetched. But:

An attack that partitioned the Bitcoin network, without having to partition the entire internet, would be surprisingly easy to pull off.

If you are designing a new global banking system, or even just a national currency, this is exactly the kind of situation you need to consider.

What happens if there is a major natural disaster, like a massive earthquake, or a war, or a cyber-war? (I wrote these words weeks before Russia’s invasion of Ukraine, but even before that reminder of the fragility of peace, you would have to be extremely foolish to ignore the possibility of war).

The internet itself was designed to cope with exactly this kind of problem. Bitcoin, however, cannot cope with major network partitions. In summary, this is what would happen:

Both sides of the Bitcoin network would carry on working (although if there was an unequal divide, one side might be slowed so much that it became unusable). Let’s imagine this carried on for a few days or weeks before connections were properly restored. At this point we would have two divergent “branches” of the blockchain, which is not allowed. By design, there is no way to merge the branches, and Bitcoin will simply pick whichever of the two branches happens to be the longest. For the unlucky half, all transactions that happened during those days or weeks of network partition would be erased.

In other words, utter mayhem.

Could we develop a satisfactory fix to this problem? No – this is an instance of the very well studied CAP theorem. The alternatives to just having weeks of data erased are also quite fun (in the sense of, “isn’t it fun to imagine how the world is going to end?”):

You try to avoid the situation by simply halting all trade and financial transactions until sufficient connectivity is restored (or this could be enforced by the protocol itself).

Instead of joining the two networks back together, you irreconcilably split the cryptocoin into two different coins.

Traditional banking doesn’t suffer from this problem. We’d certainly have problems if the internet suffered large partitions, especially because of increasing centralisation and reliance on a few big providers. But we could work around them, because the fundamental protocols of both the internet and banking are much better decentralised and much more robust. A bank transfer doesn’t need the majority of the internet to be connected – you just need the two banks to be able to talk to each other. You wouldn’t need anything to be erased when connections are restored. No doubt there would disputes in some cases, but, critically, disputing individual transactions doesn’t require invalidating the entire chain of everyone else’s transactions.

There are other serious ways that cryptocoins can or have failed:

-

Centralisation that puts the network under the control of an insufficient number of independent entities to ensure trustworthiness.

The idea of decentralisation is that there are a large number of independent entities that collectively run the network, making it very difficult to corrupt. While in theory the “mining” process that validates transactions is decentralised, there is actually an extremely high degree of centralisation in many popular cryptoassets.

Centralized systems have a single locus of control. Subvert it, and the system is at your mercy. It only took six years for Bitcoin to fail Nakamto's goal of decentralization, with one mining pool controlling more than half the mining power. In the seven years since no more than five pools have always controlled a majority of the mining power.

In other words, Bitcoin has already failed in this regard, and as Rosenthal explains, this is due to a fundamental flaw in the protocol: “proof of work” provides financial motivation for centralisation, because it makes more sense for miners to club together and pool resources to improve their lottery chances.

David Gerard explains the same thing – decentralisation of Bitcoin is a myth.

A high degree of centralisation can lead to problems such as “51% attacks”, which allow the same cryptocoins to be spent more than once. These have already happened multiple times to other cryptoassets, but not to Bitcoin’s blockchain at the time of writing.

“Hard forks” – another way of splitting a cryptocoin in two. Because there is no-one in charge, there is nothing to stop a group of participants deciding to erase a whole section of the blockchain and declaring their new chain to be the “true” one. In general it’s not easy to do, but it happened to Ethereum in 2016, and the fork “won”, because it was backed by influential people (the founders of Ethereum) who considered that they had been “cheated” – even though the cheater was technically the one playing by the rules.

Interlude 1: Assessment so far

The issues highlighted above are, by themselves, enough to ensure that Bitcoin and all similar cryptocoins are not even close to being viable currencies for any sensible nation state, and never will be. They are entirely unfit for purpose due to needing a global, well-connected internet in order to do local transactions securely. It has also been demonstrated both in theory and in practice that they cannot give us even the advantages they promise, like decentralisation.

Could they perhaps serve as some kind of potential “auxiliary” money system? Well, it kind of defeats the point of having a currency to have more than one, and there are a bunch more costs and disadvantages…

Ledger technology

The Bitcoin blockchain is essentially a public ledger of transactions. As such we can compare it to other systems that maintain ledgers of transactions. As well as security, mentioned above, another axis of comparison is efficiency.

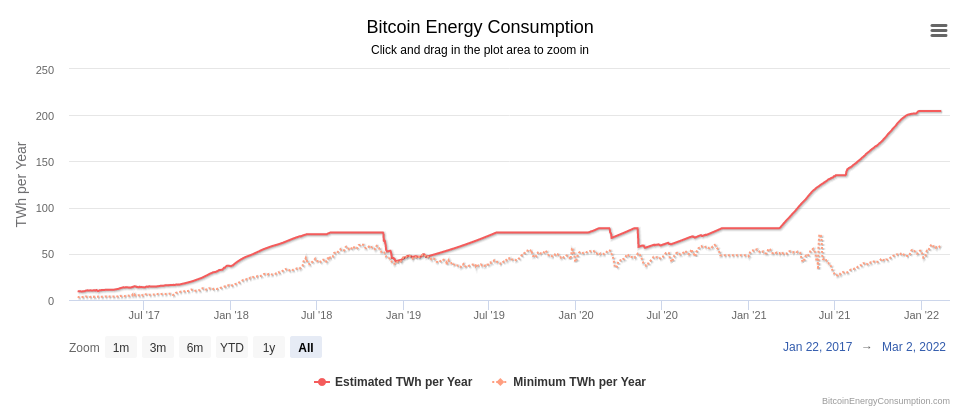

The “proof of work” method for consensus makes Bitcoin astonishingly inefficient. In addition, the self-adjusting nature of the protocol and economic factors mean that the higher the dollar value of Bitcoin, the more electricity it will use.

The result is that at the time of writing, a single Bitcoin transaction requires approximately 1 million times more electricity than a Visa transaction, or at least several hundred thousand times. (Source 1, source 2).

Let’s pause to think what a ridiculous factor that is. Imagine a new vehicle, being seriously proposed, that used 1 million times more fuel than a typical car: a full tank of fuel would move it a majestic 50 cm from its parking spot.

In response, Bitcoin proponents would prefer to compare total Bitcoin energy consumption, which now probably equals that of the whole of Finland, with the entire traditional banking system. That’s ridiculous however – the global banking system actually provides global banking services – including physical cash, instant electronic payments of many kinds, loans etc. to a high proportion of the world’s population. Bitcoin, on the other hand, provides banking services to virtually no-one (relatively speaking), and, in addition, still relies on the global banking services because you can’t actually use Bitcoin to pay for anything.

If you care about climate change or looking after the planet, which I believe you should, then this should weigh as a very important consideration. Or even if you don’t, you should still care about waste, and the resources that will necessarily be diverted away from useful things.

One of the original claimed motivations for Bitcoin was “reducing transaction costs”, which is looking quite ridiculous. Even if, for some cryptoassets, transaction fees paid by the end user are low or zero, the negative externalities here are absurdly high.

Money technology

New currency required

For this system to work, the protocol has to be able to reward “miners”, and without relying on any other financial institution. This means that it has to create a new currency – Bitcoin or Dogecoin or one of many others. Every different blockchain requires its own currency. This is a pretty awful disadvantage, because the whole point of a currency is that you only want one. And this problem leads to a bunch more.

Money creation mechanism

In times of the gold standard, to have more money in the economy you had to physically dig gold ore out of the ground and refine it etc. This is horribly expensive, and limits the supply of money in the economy, contributing to economic depression.

Due to economic needs, we moved away from that to fiat currencies, where banks are able to create money on demand, just by opening a loan account and putting some entries in a database – a process which is almost free (apart from the time and expertise of the person who approves the loan, which is one of the services that justifies banking as an industry).

Blockchain, however, would be a massive downgrade to this – you have to use huge amounts of energy to “mine” a Bitcoin, like with gold. Except it is much worse than before: gold at least has a number of important applications, like jewellery and electronics, due to its remarkable physical and chemical properties, but Bitcoin calculations have no other value.

Fixed money supply

Bitcoin is designed such that eventually no more coins will be produced. This was a deliberate choice by the inventors because they don’t understand money, and it is a fatal flaw. As Frances Coppola writes:

As it stands, Bitcoin is unsuitable as a main medium of exchange. It simply does not have the capacity or the structural features required to support significant economic activity.

Payment technology

The global Bitcoin network, despite its astonishing electricity usage, is capable of doing at most 7 transactions per second. It’s difficult to convey just how laughably small that figure is given the size of the network and the energy it uses. People who work at big tech companies are used to designing computer systems that scale to millions of transactions per second as a minimum.

At Bitcoin’s pathetic rate, given 7 billion people on the planet, your personal equal share amounts to 2 (two) Bitcoin transactions in your entire life. What’s worse is that adding computers doesn’t make it go faster, it just adds more electricity consumption. The blockchain has “anti-scaling” features that contradict the normal scaling properties you might have come to expect or assume.

As a contrast, the much smaller Visa networks handle on average 1,700 transactions per second, with a claimed capacity of 24,000/s.

If you use Bitcoin to pay for something, you then have to wait for confirmation. This will take about 10 minutes, but it could be far more. This is pretty terrible in comparison to the 2 second swipe you need at a supermarket checkout.

We then have to point out that most places simply do not accept Bitcoin, which is because the exchange rate to fiat currencies is far too volatile — Bitcoin is a terrible “store of value”, which is one of the most important features of money.

Then there are fees. Ethereum, in addition to ridiculous power usage, also has crazy high transaction fees due to the inefficiency built into the network. For Ethereum, the so called “gas” fees for a single transaction are hovering around 30 USD at the time of writing, but they can swing to thousands of dollars (!).

Bitcoin also used to be very bad in terms of network fees, but has improved a lot. However, since Bitcoin is not in use as a currency anywhere, you’ll always get hit double with currency conversion costs, in contrast to other international money transfer systems that work with local currencies.

At this point, we have to abandon the idea that Bitcoin and Ethereum really qualify as payment technologies at all, apart from some niche cases that we’ll cover later.

Privacy and anonymity

A genuinely peer-to-peer payment system could, at least in theory, have a great story in terms of privacy, like physical cash. In place of that, and in place of the (limited) privacy your bank account can provide you, Bitcoin has a public, shared database of all transactions, which is obviously a massive downgrade.

Now, blockchains are in theory anonymous, in that human names don’t appear in them. Instead, you are represented by your public keys. However, if anyone ever learns who owns a key, your anonymity disappears, and it is highly likely that, over time, connections between keys and people will emerge.

If you are willing to put extra work in and bounce money around, you may be able to achieve a reasonable level of anonymity using Bitcoin, but for most people with “nothing to hide”, there will be no motivation to do that. For these reasons it is now widely accepted that Bitcoin offers very poor privacy (although some other cryptocoins are much better).

Irreversibility

It is one of the main features of Bitcoin that, in contrast to traditional banking, transactions are irreversible – coins can only be moved with the permission of the owner. According to the whitepaper, this is one of the primary motivations for Bitcoin, due to its ability to stop buyers committing fraud — such as when a buyer pays and receives goods, but then is able to do a chargeback on their credit card, fraudulently claiming they didn’t get the goods.

Attempts by Bitcoin to prevent this seem to miss the point: reversibility in traditional banking is a deliberate feature, and one that comes from laws, not an accidental bug that needs to be fixed by technical means.

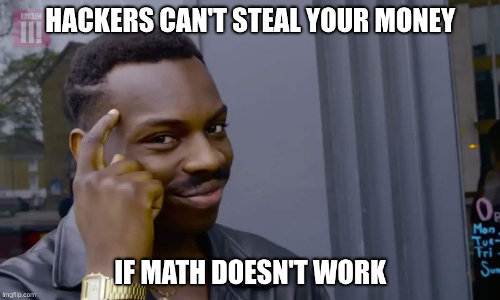

In the Bitcoin system, the advantage that irreversibility provides is at least equalled by the downside of making it much harder, or impossible, to counter fraud by sellers, and other people like hackers.

Let’s consider the cases: I order some goods on internet. If I pay upfront, there is every possibility that the seller will take my irreversible payment and never send me the goods. So I refuse to do that, and instead we do payment at the door – the delivery driver doesn’t finally hand over the goods until I confirm the payment. This is already pretty inefficient, especially if they have to wait 10+ minutes for confirmation on the network. However, when I get inside, I discover that the box is empty, or missing something vital. Maybe I discover it a week later, but there is now nothing I can do.

The balance has been tipped, but much too far – consumer protections are out of the window. What we want is for reversibility to be technically possible, but controlled by appropriate laws that can be reviewed and changed as needed.

Irreversibility is by far the most impressive feature of blockchain, but it is a feature you absolutely don’t want.

In reality, however, local laws would probably still apply, so you would still have legal methods to pursue a refund, as long as you lived in the same country. They would just be more inefficient. All this shows a more general point: if you can work “outside” the virtual system (by virtue of human beings having physical bodies that have to live in a geographical place with laws), then the guarantees you can make within the system quickly become pointless.

Also, irreversibility is basically incompatible with the way that the rest of banking works, giving further opportunities for fraud when people forget this — including clever people like Apple co-founder Steve Wozniac — and adds major hurdles if you want to buy and then immediately use cryptocoins, unless you buy in cash.

Banking technology

Let’s explore the options:

Be your own bank

The major innovation that Bitcoin claims is that it does away with the need for banks. Instead, you can be your own bank. This is possible because of the way that Bitcoin works effectively as something close to, but not quite, “digital cash”.

We have to explain that for a second, because a wrong mental model will lead to many wrong conclusions – and could leave you wide open to losing all your digital coins if you have any.

Bitcoin builds on public key cryptography, which is an extremely useful technology based on mathematically connected pairs of large numbers. One number in each pair is called a “public key”, the other the “private key”. The public key, as the name suggests, can safely be shared with everyone. It can then be used by other people to test the authenticity of messages generated with the corresponding private key, which must always be kept secret by the owner. The public key can also be used for sending encrypted messages that only the private key owner can read.

In Bitcoin, public keys function as “addresses” to which you can send money — like a bank account number. The Bitcoin protocol uses cryptographic signatures to ensure that only the owner of an address can transfer money away from that address.

In this system, knowing the private keys is of critical importance:

with those keys, you can move your cryptocoins around and spend them.

without those keys, you cannot do anything.

So you need to store them safely! And this leads to the concept of a “digital wallet”. Technically it is the blockchain that stores the record of how much Bitcoin you have, and your wallet stores just the keys. But those keys are everything, so the metaphor of a “wallet” containing “digital cash” is a helpful one.

Your “digital wallet” could be:

on your computer or smart phone,

in a specialised hardware device, called a hardware digital wallet. These are popular especially because of the threat of your computer being hacked, and your software wallet compromised.

So, if you lose your digital wallet, your money is gone forever. If your wallet is stolen, your money is gone. If your hardware breaks – like from water damage — your money is gone. If the computer storing your software wallet is hacked, your money is gone.

Due to its “cash-like” nature, cryptocoin transfers are also irreversible. There is no bank who can step in and grant you a refund.

The metaphor of a wallet breaks down a bit, because, unlike cash, it is, or can be, very easy to copy a wallet. While hardware digital wallets are often designed to make it hard to export keys or make copies, software wallets will allow you to make backups, which is good for recovery – but also opens up more opportunities for theft. For example, you might be vulnerable to theft by an app on your computer.

And if someone has an unencrypted copy of your keys, they can use the contents without your permission, or even knowledge – until you check and find that your wallet is empty. This makes it work very differently from a physical cash wallet.

Most if not all digital wallets will use strong password-protected encryption to stop other people getting access. This is a mixed blessing: unlike the password to your online banking, the passwords here are not mere access passwords that can easily be reset. Rather, they are encryption keys, which means they are used to scramble your data while it isn’t in use. If you forget the password, the data remains scrambled forever. It is mathematically impossible to reverse the scrambling without your password, meaning your money is gone.

Encryption also doesn’t really protect you from many theft scenarios. If someone steals your hardware digital wallet, they may not be able to access the contents, but that is small comfort because you can’t either. And if they ask for the passphrase while pointing a gun at your head, or your child’s, are you going to refuse?

I’m labouring all this to point out that when you are your own bank, you become responsible for looking after all your money, and you have to know all this stuff. It’s like storing your life savings in cash under your bed, but in some ways worse – a digital wallet is more portable for a thief, can be easier to access remotely depending on how it is stored, and is also much easier to accidentally destroy or lose.

I agree with Hobbes on this one.

Oh, and by the way – unlike with physical cash in a suitcase, being your own crypto bank will not protect you from a “run on the bank”. The equivalent in the crypto world, in which lots of people rush to convert their virtual money (Bitcoin/Ether/Tether etc) into real money (dollars etc) would cause a massive crash in the price. There is nothing like sufficient liquidity in the system, so the vast majority of people would lose almost everything. You’d still have your Bitcoins, of course, but they would be worthless.

Use an exchange

So you’ve decided, wisely, that securing your home and your computers, both physically and digitally, to the point where they could function as a bank is a terrible idea.

Now, logically, you should have rejected cryptocoins completely, since they only exist to allow you to do just that. But let’s say that instead, inexplicably, you still want to use them, so you decide to use an exchange. You hand over your private keys (or your coins) to a company, they look after them and use them for you, on your behalf.

This means:

you have to trust this organisation not to run off with or lose your coins.

as an intermediary they can track you.

and they can also block you from using your money.

In other words, back to where we were with banks. Except it’s worse. Much, much worse.

The first problem is that the companies operating in this arena are perfectly aware that cryptocoins are simply a “greater fool” scam, with the fools being their customers. It can be no surprise then, that the biggest names, like Binance and Tether, are regularly embroiled in scandal after scandal, with pump and dump schemes everywhere. In fact it is all a giant scam, and sometimes they even openly admit this.

Further, cryptocoin exchanges are hacked with astonishing frequency and for astonishing amounts of money, with, to date, $2.66 billion stolen since 2012. It seems almost every day there is news revealing incredible incompetence, including that time when a CEO died and took the exchange’s fortune with him to his grave.

Crypto.com, whose “fortune favours the brave” advert likened using their gambling services to being an intrepid explorer, had $30+ million stolen just the other week as I write this. I’ll grant them that you would indeed have to be very “brave” to become one of their customers.

You should also know that, compared to banks, you probably have far less legal claim on your money in the case of an exchange going bankrupt. It doesn’t matter that you technically “own” the crypto you’ve given them, you’ll be last in the queue for getting anything back.

The problems, however, are not just dishonest or incompetent people running the exchanges, or the fact that you don’t have deposit insurance or legal rights. The cash-like nature of cryptocoins, in particular the irreversibility and relative pseudonymity of transactions, make crypto exchanges a massively more tempting target for criminals, and this is only likely to continue and get worse.

We can contrast this to money in a bank account. Your bank doesn’t “store” your money. It has some cash reserves, but none with your name on it. Money is just a record of debt: your current account balance is just the amount of money the bank owes you, which happens to be recorded in a database. If someone deletes the database, your money does not get deleted, because the legal debt remains. There is no equivalent to the “private keys” in cryptocoins that give hackers control over money. If someone succeeded in hacking into a bank and completing a bank transfer of a large amount of money, it would have a very clear destination — another bank and account – which usually makes it pretty easy to trace, reverse and prosecute.

Of course there is still the possibility of hacks on banks being profitable for criminals, but the practical difficulties are much greater than with cryptocoins.

And we haven’t even covered the many more everyday kind of scams played on individual crypto owners. Similar scams exist with normal money, but with cryptocoins they are made all the more likely by the obscurity of the technology, and much harder to recover from due to irreversibility.

So who is this good for?

There are in fact some people who, despite the terrible disadvantages, use cryptocoins as a form of payment or money transfer technology, its original intended use case. This happens:

when they have no other option, or,

when profit margins are very high, so high volatility is of less importance, and irreversibility and (potential) anonymity are of critical importance.

Who does that apply to? Criminals. Cryptocoins are a boon for criminals, especially those operating internationally. It makes a perfect payment mechanism for ransomware, which has seen a dramatic rise in recent years and is also excellent for money laundering. High volatility of the price is a small concern when you are stealing, and the extra steps you need to achieve privacy are no problem for the more competent criminals, who are making the most of “privacy” services like Tornado Cash.

There will probably be some other legitimate, non-criminal users. But it is always true that deregulation sometimes helps some people.

For example, if we completely deregulated the sale of medicines, it would make it easier and cheaper for genuine medicines to reach the people who need them. There would be cases where this might even save lives. But it would also be easier for all the fake and dangerous medicines too, which are of course cheaper to produce, so pretty soon legitimate companies will suffer massively, as well as the general public – which is why we have regulation.

So of course you can find isolated instances where cryptocoins have enabled someone to work around an oppressive regime and get some money they desperately needed. But, given the kind of terrible disadvantages in comparison to normal money, it is inevitable that criminal activity will get by far the biggest boost, which is bad for everyone.

Are there other uses?

Whether you look them from the angle of “money”, “payments” or “banking” technology, cryptocoins have achieved an impressive level of failure. Anyone who is honest has given up on the idea of cryptocoins as money.

Instead, apart from use by criminals, it is in demand only because of a financial speculative bubble based on a negative-sum “greater fool” scheme, which is both immoral and destructive. (That’s not really the subject of this post, so I’ll leave it to other articles, but just to note – the leading crypto-proponents are not just admitting that crypto is a Ponzi, they are bragging about it).

However, at this point, crypto-proponents will claim permissionless blockchains are useful because of “revolutionary” technology that can be built on top of them. Let’s have a look. If we must…

Blockchains for databases

One way to look at blockchains is as immutable, distributed tamper-evident databases. Breaking that down:

immutable means that you cannot change any data on them – you can only add more records (“append only”). This is nothing new.

distributed means there isn’t just a single copy of the data – there are many redundant copies. This is also nothing new.

tamper-evident means you can tell if someone has tried to change data later. There are other tamper-evident databases, but blockchains are bringing something new here in terms of operating in an environment where we don’t trust anyone.

Described like this, it does sound like something that could have some interesting real world applications.

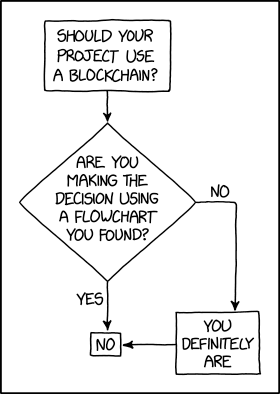

Unfortunately, in the 12 years since it has been invented, virtually no real use cases have turned up, and certainly nothing that would come close to justifying the astonishing inefficiency of the technology. It is the amazing solution for almost nothing.

The first huge problem is this:

You may be able to store information in a tamper-evident way, but how are you going to ensure the information is actually true?

This is a fatal flaw in almost all attempts to use blockchains for anything. As Calvin put it, “reality continues to ruin my life”.

For example, “Verisart” is a blockchain company who will record authorship of artwork on the blockchain. It wasn’t long before a prankster called Terence Eden got himself recorded, immutably and eternally, as the painter of the Mona Lisa. [5]

The next issue is that if there is a person we can trust to not lie about the data in the first place, there are massively more efficient systems for recording that information. We can just use a database, and keep redundant copies with some auditing functionality. In many cases we could additionally use well-established, efficient cryptographic techniques like public key certificates – the same system your web browser uses to check the authenticity of websites.

The reality is that the only kind of truth-claims that blockchains are suitable for managing are about the cryptocoin associated with the blockchain – Bitcoin for the Bitcoin blockchain, Ether for the Ethereum blockchain etc. – and that is only because those blockchains are by definition the source of truth for that cryptocoin.

Note also that you can’t just remove the cryptocoin and keep the blockchain technology – a permissionless blockchain requires a speculative cryptocoin to power it, otherwise no-one will ever pay for it, as David Rosenthal explains:

Because miners' opex and capex costs cannot be paid in the blockchain's cryptocurrency, exchanges are required to enable the rewards for mining to be converted into fiat currency to pay these costs. Someone needs to be on the other side of these sell orders. The only reason to be on the buy side of these orders is the belief that “number go up”. Thus the exchanges need to attract speculators in order to perform their function.

Thus a permissionless blockchain requires a cryptocurrency to function, and this cryptocurrency requires speculation to function.

Smart contracts

The Ethereum blockchain, compared to Bitcoin, adds the ability for the whole network to run custom code, known as a smart contract, which can be used for moving coins around.

This is a potentially interesting feature, but with massive flaws.

The entire premise of the smart contract is that you don’t have to trust a person you are entering into agreement with, but you instead read the code of the smart contract, and then trust an independent, distributed machine to execute the code exactly as written, because it cannot do anything else.

So, all we have to do now is create a programming language where the code is perfectly readable by ordinary people, and cannot easily harbour accidental bugs, or deliberate hacks.

If we had anything close to that, every software developer in the world would be out of a job. We’ve been trying to design programming languages like that for decades, and it’s impossible.

Oh, and in addition, with smart contracts, you don’t get to try out your code in a real environment and fix it if someone finds a bug. If they find a bug – all the cryptocoins you sent to that contract will probably be gone (depending on the exact nature of the bug). You’ve got to get it right first time, because of irreversibility.

Experienced computer programmers everywhere:

The next flaw is that for smart contracts to be useful, they have to interact with the real world, and get truthful data into them. However, as already discussed, there are no trusted “inputs” to blockchains. They can only trust the record of their own coins. This massively limits the usefulness of such systems. Everyone trying to build anything useful seems to forget The Inevitability of Trusted Third Parties which renders the entire endeavour pointless or worse.

So much for the theory. In practice, how is it working?

The language Ethereum uses is called Solidity, which presumably is ironic,

because it is a terribly badly designed language. As a simple example, consider

a case where we have a and b representing integers. If you know normal

algebra, and you saw an expression like a + b, you might expect that this

would equal the sum of a and b.

In Solidity, a + b sometimes equals a plus b. But sometimes it

does not!

Isn’t that fun?

Is this a big deal in practice?

-

In 2016, the creators of Ethereum themselves wrote a smart contract for “The DAO”. A bug allowed an attacker to drain so much money that they “forked” the entire Ethereum network to get it back. This is basically a “reset the database to yesterday and declare our version to be the winner” undo operation.

(If you’ve been paying attention – yes, that negates the entire promise of blockchains being immutable, and it being impossible to get around smart contracts. It turns out that if you pretty much own the whole system, which the Ethereum creators do, or at least did, you don’t have to obey the rules.)

Last week at the time of writing, Qubit Finance begged hackers to return $80 million extracted from a buggy smart contract.

A few days ago, more than $320 million was lost in a smart-contract hack involving a bridge between Ethereum and Solana.

Go to web3isgoinggreat and search for “smart contract” and you’ll find tons more. Ethereum’s smart contracts are full of holes.

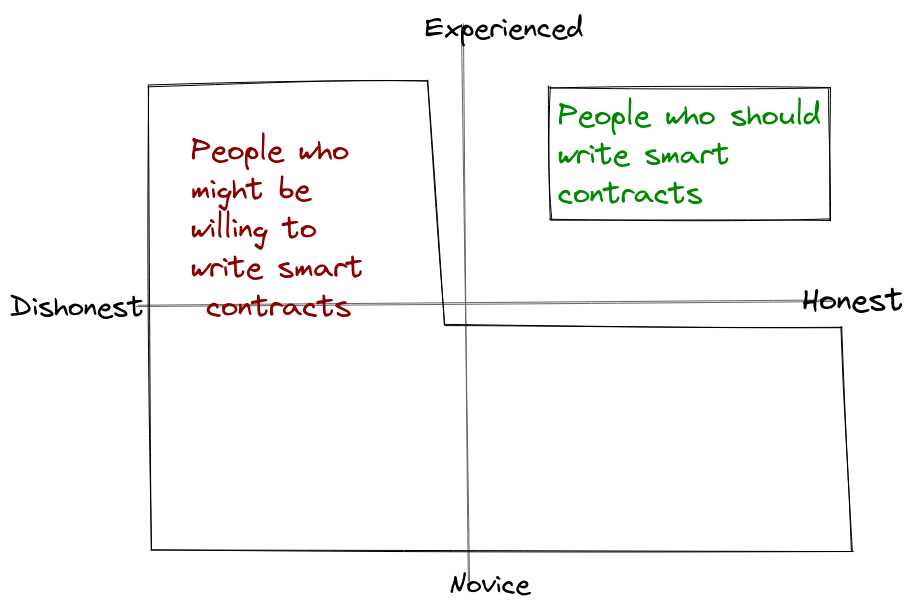

Could you fix this by spending enough money on finding a programmer you could trust to write or check smart contracts? You won’t find such a person:

It’s obvious that the only quadrant you should be hiring from is the top-right “experienced, honest” group. But these people cannot be hired, because they know they can’t do it reliably, and they will admit that.

You will definitely attract lots of people from the “experienced, dishonest” quadrant, however:

People who are quite happy to take the money you throw at them and say “sure, I can build a reliable smart contract”.

People who will write “accidental” bugs that allow “someone” to steal all your money outright (but deniably, of course, due to the anonymity of blockchains, and the difficulty of writing correct code).

NFTs

NFTs are like someone invented a way to make money out of people buying digital art, except they forgot the “buying digital art” bit.

I knew I forgot something!

They are based on the idea of recording “ownership” on a blockchain, normally the Ethereum blockchain. Let’s do this one as a Q&A:

When I buy an NFT, have I bought exclusive legal rights to the art? No, they remain with the artist.

But I bought legal rights to at least use the art, right? No. In some agreements you might have various additional rights to use it, but it’s not a legal part of the NFT.

Does the NFT contain the art in some sense? No, it contains a reference or link to the art, plus a digital signature, recorded on the blockchain. The blockchain is far too expensive to actually store more than a link.

Can I check that the art stored at the link hasn’t been changed? That would have been a really easy thing to add, for anyone with a really basic understanding of cryptographic techniques, but tons of NFTs don’t even do that.

Is the link guaranteed to continue to work, and be censorship-proof, like the blockchain itself? No, it has to be stored somewhere, and you’ve got no guarantee it will continue to be available.

Is there guaranteed to be only one NFT for each bit of art? No, there can be any number of NFTs of the same artwork.

So what have I actually bought? You have effectively bought an entry in a database that has a vague association with a bit of art, with the ability to sell that entry on, in the context of that database, and literally nothing else.

Do I know that the NFT is guaranteed to have come from the artist? No, anyone may “mint” an NFT of anything at anytime. This is what “decentralised” means here – there is no central, trusted authority who can block minting. This is by design and cannot be fixed.

Do I know that that the artist received some of the money I paid? No – first, it could just be a fraud (see previous question); second, the money you pay goes only to the previous owner. Some marketplaces try to pay royalties on every sale, but it’s not part of the NFT protocol so it’s out of their control.

As an artist, do NFTs provide a new way for me to make money out of my art? Yes they do. They also enable everyone else to make money from your art. That’s why many artists are being forced to take their art offline due to a new wave of rampant copyright violations and fraud.

But artists are making quite a lot of money of this, aren’t they? Certainly a few are, which is entirely predictable. On average, they are probably losing money, not accounting for all those who aren’t even playing and just want to stop getting plagiarised.

Is this some kind of joke? Well, a lot of people are laughing all the way to the bank.

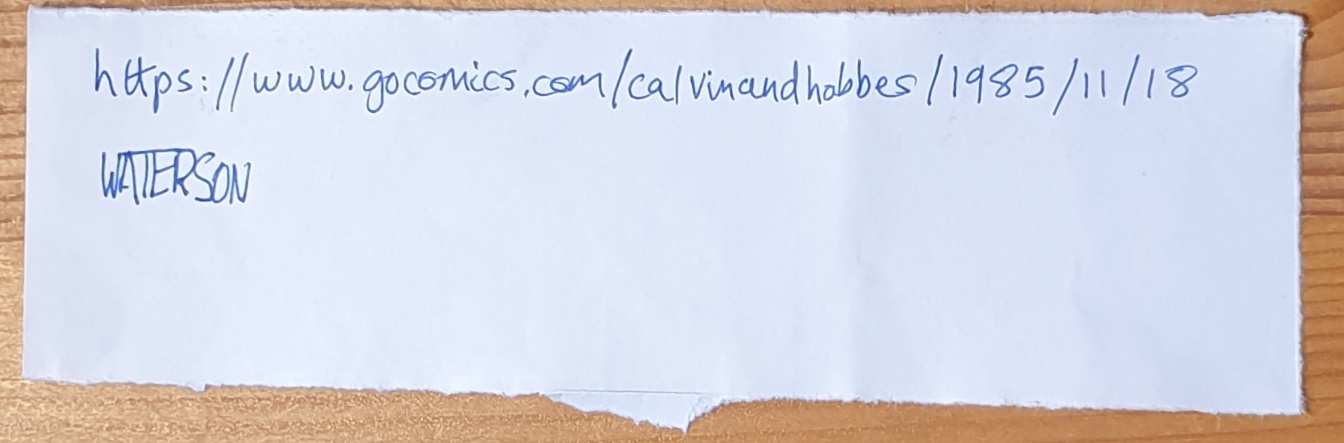

Legally speaking, buying an NFT is exactly like buying this piece of paper, which has a link to the first ever Calvin and Hobbes strip:

It’s unique and “non-fungible” – there is no other piece of paper exactly like this one. Is it “genuine”? Well, it’s a real piece of paper if that’s what you mean, and the link works. Otherwise you’ll have to work it out for yourself. But it’s yours for just $1 million!

It is really difficult to describe just how little sense NFTs make. It’s like people trading baseball cards, which is fine, except you realise the traders believe or claim they are actually trading baseball players. Baseball players and baseball cards, however, are at least physical things, whereas an NFT gives you the ability to trade in the fantasy of owning a sequence of bytes, and nothing more.

For what they do, you could provide exactly the same service by switching to a simple centralised database, which would also allow you to regulate it and avoid copyright violations etc. All without any blockchain, and for a tiny fraction of the outrageous and entirely unnecessary costs involved in NFTs.

Even the inventor of NFTs, Anil Dash, has realised they do none of the things they were originally intended to do, but they do create perfect opportunities for money laundering and fraud.

As for the claim that NFTs allow you to create “digital scarcity” – a truly bizarre boast to make – they simply cannot do anything of the kind, outside of the make-believe world of a blockchain. Minting an NFT of some digital art makes literally zero difference to anyone else’s legal right to use that art.

The conclusion is this: whatever the original intention, NFTs currently function as just two things:

a source of unique casino chips that you can gamble with.

a method of making demand for otherwise useless cryptocoins like Ethereum and friends, in order to on-board more people into these “greater fools” schemes that are rapidly running out of new fools.

This means that none of the above deficiencies of NFTs actually matter – and, attempts to fix them are just dissembling – because NFT trading is not about owning art, but gambling in an art-themed casino.

NFTs of everything

Not content with miserably failing at digital art, NFTs now have ambitions to fail at everything else. As an example, one proposed use is for “in-game assets”. The idea is that you buy an NFT of some digital asset, and can then use that asset in a video game.

This has so many flaws I don’t know where to start.

First, this is going to require tons of work for game authors. What’s in it for them?

Then, game authors would effect be honouring someone else’s completely valueless casino chip. Why would they do that?

Then there are copyright and fraud issues. Ownership of an NFT tells a game author precisely nothing about the provenance of a digital asset, and the entire space is absolutely overrun with frauds and scams, such that 80% of NFTs listed on OpenSea are fake or plagiarised. This is kind of obvious – a permissionless blockchain where anyone can write anything is a pointless place to store information about “ownership”. Why should game authors try to wade through this mess which they didn’t make?

So, what do game authors themselves think about this? This is from itch.io, an indie game platform (language warning):

A few have asked about our stance on NFTs:

— itch.io (@itchio) February 6, 2022

NFTs are a scam. If you think they are legitimately useful for anything other than the exploitation of creators, financial scams, and the destruction of the planet the we ask that please reevaluate your life choices.

Peace ✌️

Also f̸̗̎ú̴̩c̷̖͌ḳ̵̀ any company that says they support creators and also endorses NFTs in any way. They only care about their own profit and the opportunity for wealth above anyone else.

— itch.io (@itchio) February 6, 2022

Especially given the now easily available discourse concerning the problems of NFTs.

How can you be so dense? 😢

— itch.io (@itchio) February 6, 2022

Why the anger? Because they understand the tech, and know it’s a scam. Also, I’m guessing they know that the many clueless suckers who have bought NFTs, believing they confer some kind of ownership, will soon be pestering itch.io to honour their worthless casino chips.

Certainly there is a market for buying digital assets that you can use in a video game, but NFTs provide no legal, usable infrastructure that game authors can use. Games are probably one of the few places where artificial scarcity does in fact make sense. But from a technical perspective, it’s an absolute doddle to achieve! Which is why many games already have perfectly functioning economies for such digital assets – under the control of the game authors, which is needed for achieving game balance. With no blockchain.

DAOs

Decentralised Autonomous Organisations are a magical reinvention of traditional organisations, in which smart contracts decide how money gets spent, making it mathematically impossible to be evil in any way, powered by The Blockchain, explicit one-coin-one-vote plutocracy (what could possibly go wrong?), Good Intentions (possibly), Poor Thinking (definitely) and Unicorns. All you need to do is convert your entire existence into a program and encode it into bits so that you can now literally live on the Ethereum blockchain where you can be governed by its rules. Also, you get a free unicorn with every DAO membership, cool!

Sorry, that’s all I can do. There is so much nonsense here that I’m running out of the will to live.

web3

It’s hard to say exactly what web3 is, because it is just a marketing buzzword, and it mostly does not exist. It’s meant to be some kind of re-invention of the web around blockchain technologies.

The narrative spun around it involves “taking back the web” from the big tech giants who unfortunately seem to control it these days, usually involving a revisionist history of where we’ve come from.

But none of it makes any sense. Putting data on blockchains doesn’t give you control over it – if anything it removes control, because now it is there forever, immutable. It gives you ownership in the same way that naming a star with the International Star Registry gives you ownership of a star (that is, not at all). Using smart contracts to control it suffers from all the same problems I already mentioned.

And then there is the cost. Did we talk about the cost and inefficiency of storing your data on blockchains yet? Right…

Prices fluctuate enormously, but at the moment storing 3kb on the Ethereum blockchain will cost you $250 dollars.. That makes it about 10 million times more expensive than a cloud service like Amazon S3 [6]. There are essentially no use cases where the peculiar and weak set of advantages that blockchains give you would make that worth while.

Then there is querying – i.e. reading the data. When I said that blockchain was like a database, I meant only that it can store data – not that it does so in any convenient or efficient form. So, if you want to actually read the data, you’re first going need to import it into a proper database designed for that. Unfortunately, 99.99999% of the data on the blockchain is data you don’t care about, but you’ve got to load it to find what you are interested in.

This is profligate inefficiency, and will only get worse with time, so if you are attempting to build anything “web3” you will probably need to pay for another service to do that for you, increasing costs and complexity, and increasing your reliance on centralised services that could block you. Making this whole thing worse than pointless.

Any real software engineer who looks at the architecture of a web3 application finds it completely ridiculous. It adds an unbelievable amount of complexity and cost, for no actual benefit.

Now, under the name of “web3”, you do sometimes hear other projects mentioned, like IPFS, which are honest attempts to mitigate some of the real problems that the current internet has. I can’t comment on how well they work, but every useful one among these that I’ve seen doesn’t actually need or use permissionless blockchains at all.

Conclusion: web3 is a fraud. It appears that its primary purpose is to try to lend plausibility to the increasingly discredited idea that blockchain provides some useful technological innovation. Or, it’s a ploy to put crypto-lovers in charge so that they, rather than big tech, can be the ones extracting rent. As the Register put it, paraphrasing Douglas Adams:

Web3 is “a myth, a fairy story. It's what parents tell their kids about at night if they want them to grow up to become economists.” ®

Can we fix it?

I know that many Bitcoin proponents will by this point be livid about how unfair I’ve been, itching to point out all the solutions to some of the issues I’ve raised. However, most of their responses can be characterised in this way:

“But we can work around the horrible deficiencies in this technology by not using this technology!”

This is of course true, but entirely irrelevant, and not a good advert for the underlying tech.

It’s also impossible to work out why we should be even trying to fix these things. As James Mickens put it:

If you want to make money better, why not try to just improve money, instead of starting with a disaster and trying to improve the disaster?

As I’ve attempted to look through some of the proposed solutions, I’ve found it like responding to conspiracy theorists – there is no limit to the amount of exhausting nonsense you have to wade through. But anyway, to address some of the major claims that the flaws can be fixed:

Upgradability

There are many theoretical improvements to Bitcoin that could be made. For example, Solana claims thousands of transactions per second, and Monero has much better privacy. Bitcoin has not adopted these – why not?

Putting aside the fact that these improved systems are still hundreds or thousands of times worse than non-blockchain solutions on the very metrics they boast about, we can still ask: why hasn’t everyone “upgraded”?

The answer is found in the fact that:

public, permissionless blockchains are not controlled by anyone, by definition.

they couple together a speculative asset and a ledger technology, because this is the only way to motivate anyone to join in the consensus protocol.

This means no-one can force anyone to upgrade, and they will only do so if it is in their financial interests. So, small bug fixes are fairly easy to coordinate, but fundamental changes that are detrimental to the bottom line of the majority of players are almost impossible.

Instead of upgrading existing cryptoassets, why hasn’t everyone just switched to the “better” blockchains? Because that would involve a huge gamble. If people admitted that their current “investment” was now obsolete, the price would crash. Since we’ve already abandoned the idea that these things have any actual utility, it doesn’t really matter how bad they are at what they do.

Since a cryptoasset’s market value depends only on popularity and hype, there is a religious-level devotion to specific coins, and it needs to be there, so that you can continue to on-board new recruits to make the price of your coin go up.

This means that permissionless, public blockchains are probably the most progress-resistant technology ever invented.

Consider, as a contrast, the UK’s Faster Payments Service. First going live in 2008, it was an upgrade by a factor of 100,000 in terms of transfer speeds compared to the old CHAPS/BACS systems. These days pretty much everyone in the UK can do free, interbank transfers within seconds, up to £1 million, 24/7. In 2021 it handled 3.4 billion transactions, that’s an average of 110 transactions per second, although peak will probably be much higher than that, and scalability will be determined only by demand.

When this upgrade happened, it didn’t require the whole world to change, or even the whole of the UK. We didn’t have to switch to an entirely new currency – that would be crazy, right? This is just a communication protocol, so it only required two banks to use it to be useful. Then eventually everyone got on board. End users like me didn’t even have to know about how any of it works, we just noticed that things got better and faster. Real-world institutions like banks can be slow to change, so things can take decades, but they do get there.

Bitcoin went live a year after FPS, but despite being a brand new technology, defined only by software and without the legacy of having to deal with existing infrastructure, and consuming vastly more resources, still does only at most 7 transactions per second. Meanwhile, due to its perverse economics, energy consumption per transaction has grown hugely.

Coupling the definition of a currency to a specific ledger technology is a truly terrible idea that makes cryptocurrencies not only a huge downgrade, but a downgrade to upgradability itself, which is much worse.

If we want better money technology, the first thing we need to “fix” is the idea that people can just invent their own currency, and award themselves and other early adopters huge amounts of it, due to “innovation” – which might be nothing more than the novelty of a joke name. This approach, shared by all the cryptocoins, is guaranteed to produce terrible results both technologically and economically.

Scalability

One attempt to tackle the scalability of Bitcoin is using a “Lightning Network”. The idea in its simplest terms is that you do lots of transactions “off-chain” (not recorded on the blockchain), then just settle up on the blockchain, but with a lot more complexity.

There is a huge amount of both hype and criticism of this network. But for our purposes:

The original design could not possibly work at the high scale envisaged.

Modified designs are just reproducing things like the Visa/Mastercard networks, where you have a third party that you trust to settle up when direct bank-to-bank payments are difficult for whatever reason. Except more complicated, and therefore less efficient, and the developers don’t appear to realise that they have created a bank to which you have to lend in order to send a payment.

Its Bitcoin bottleneck means it cannot come close to the scaling needs it is supposed to address.

A 2019 analysis shows that the network has to run at a loss to get the low transaction fees it boasts – meaning that it is being artificially propped up.

It still suffers from all the other problems – like you have to pay with Bitcoin (or some other cryptoasset) instead of an actual currency, with all its volatility issues etc. Also, the Bitcoin network itself will still continue to consume the same vast amount of electricity, for no real benefit. So the Lightning Network isn’t a case of improving efficiency by reducing load on an obsolete technology – you get the waste of both systems combined.

Energy use

Many attempts to fix the terrible energy use of Bitcoin miss the point: the inefficiency is deliberate, and necessary for security (if you are relying on “proof of work”). Many coins that boast less power usage can do so only because they are less secure, or because they are less popular.

But let’s look at some specific attempts:

Proof-of-stake

In place of proof of work, “proof of stake” has been suggested, and is already used by some blockchains. It’s technically complicated, but there are huge problems with it:

It is an explicit plutocracy – rule of the wealthy. The people who have the most coins get the most votes to control the network.

The wealthy also get the greatest rewards. “The rich get richer”, i.e. an ever increasing concentration of power and wealth, is an inevitable consequence of the design.

There is a strong economic argument that it can’t reduce energy consumption anyway, it will just make it less obvious.

Ethereum has a plan to switch to proof of stake that’s currently “about eighteen months away, where it’s been since 2014”. This may be an indication either 1) of the upgradability problem described above or 2) that a workable implementation simply cannot be found.

See Rosenthal’s analysis for more information.

Proof-of-something-useful

Another set of attempts to fix proof-of-waste can be grouped together as “proof of something useful”. Examples include SolarCoin, which rewards you for proving that you have generated electricity via solar power, and FoldingCoin which rewards you for providing computational power for the useful task of “protein folding” calculations.

Some of these are ridiculously impractical, and obviously so – for example, in some cases they’ve got no realistic method to prevent fraud. Many of them sacrifice several important qualities of blockchain technology, to the point of being nothing more than a reward points system (but less useful). But all of them miss the point:

We already have a system for rewarding people who are providing valuable things to society – it’s called money! It does not need to be invented, and we don’t want a different currency for every product – that defeats the whole point of having a currency.

I mention these “alt-coins” only to point out that the crypto world is full-to-bursting with things that are either obvious get-rich-quick schemes, or just terrible, pointless ideas that cannot work in the real world. Somehow they are being taken seriously because they are getting on the hype associated with crypto.

Also, many of these more “eco-friendly” alt-coins are used to defend the idea that cryptoassets are not necessarily so bad for the environment, ignoring the fact that they work in completely different ways, if they work at all, and they have no chance of ever replacing the popular cryptocoins, or any real world currency.

“But it’s still early days!”

No, it’s not still early days for crypto.

When sceptics mocked the internet in the early days, the problem they suffered from was a lack of imagination. There was no dispute that the internet really did enable you to send digital information across the world in a fraction of a second. Some people just failed to see why that might be useful. In addition, it was generally people who didn’t understand the technology who made those criticisms.

Permissionless blockchain technology, on the other hand, simply does not achieve the things it claims, and the people who understand it best have pointed that out. It has already failed on many of the aims it set for itself (e.g. decentralisation, as I explain under Security, and reducing transaction costs), and completely failed for its intended purpose. Things built on top of it, like NFTs, do not and can never do the miraculous things claimed for them, and the things they can do, are done better in every way without blockchain.

It’s been more than 12 years for crypto to find a use case. By way of contrast, consider M-PESA, a mobile money company which launched in 2007 in Kenya. It took only 5 years for 70% of Kenyans to sign up for an account, giving them “near instant access to essential financial services such as deposits/savings and P2P money transfers”, when in 2006 only 20% of Kenyans had been formally banked. That’s what successful technology looks like — providing actual services to people who need it, lifting people out of poverty with dramatic effects.

Meanwhile, people today who know nothing about solving real-world problems talk about Bitcoin as “banking for the unbanked” – apparently unaware that this problem, which is not solved by Bitcoin, is being solved by technologies that actually work.

At some point, when technology is having damaging effects in the real world, you have to be willing to reach a conclusion. At some point you’ve got to stop giving the benefit of the doubt and be ready to say this is a Theranos that needs to be shut down.

Conclusion

I’m horribly bored of this subject now, but just to sum up:

Blockchain technology is a train wreck. For its intended purpose, whether we think about it as money, payment or banking technology, it’s beyond useless – an unbelievably inefficient non-solution whose most impressive features are things we don’t want, that also gives us huge downgrades in every aspect that we do care about.

For any other purposes, it appears to be even worse. We can’t say with 100% certainty that a genuine use case will never turn up, but, as The Register put it, “you'd be better off betting on Freddie Mercury being beatified by the Vatican”.

The problems with it are not fixable bugs, they are deep design flaws. The only possible way you could claim this was a technological revolution is by noting that the word “revolution” doesn’t indicate which direction you are going.

Technology is not neutral, and our response to it cannot be neutral. Since permissionless blockchains can only work if they are funded by negative sum financial schemes that are causing massive waste and an increase in many other societal evils, this is not just a poor technical choice I can laugh at, it’s something I have to condemn.

Epilogue

An angel and a demon were watching the goings on at the 2015 Paris Climate Conference. The demon was obviously amused.

“What are you smirking at?” asked the angel.

“Oh, I really can’t decide what’s more funny”, replied the demon. “The politicians managing to make these promises with straight faces – it’s a class act, it really is – or the fact that you are bothering to listen to them. Tell me again, why are we even here?”

“You’re wrong about humans,” replied the angel, “and always have been. If they work together, they can turn this climate situation around. You forget – they still have the image of God in them.”

“Not enough left to save them at this stage. They’re doomed.”

“But they’re such inventive creatures too,” added the angel. “What about the printing press, and modern medicine, and people in space? Then there’s nuclear power…”

“Which they used to kill millions!” interrupted the demon.

“…the internet…” the angel continued.

“…yes, full of pornography…”

“Oh do shut up!” snapped the angel. “They’re bound to come up with something to fix this, I’m sure of it.”

“Alright,” said the demon, spotting an opportunity for some fun. “I have a prediction for you. In the place of cutting emissions, the next new technology that will get popular will go in exactly the opposite direction – they will actually invent a new way to waste more fuel. So much so, in fact,” continued the demon, warming to his theme, “that they will manage to undo all the savings they have made so far. In addition, the technology will either be 100% useless to humanity, or worse – it will hurt everyone involved. It will be a case of purely self-inflicted pain that will cause further misery and accelerate them towards ecological breakdown.”

“Oh come on!” replied the angel. “We both know that even at their worst, they have enough basic self-interest to save them from complete insanity. Why on earth would they do that?”

“The usual reasons. Greed, or perhaps a desire for fame. Or maybe just mass-delusion – they’re not nearly as bright as you seem to think they are.”

“It won’t happen.” replied the angel. “Willing to put your money where your mouth is?”

“Certainly. Ten thousand says it will have taken a hold before the next Paris conference in 2021”.

“Dollars, I presume?” asked the angel. “We could use one of those fancy new tokens, ‘cryptocurrency’ I think they call them, just to spice things up a bit?”

“You’re always so behind!” scoffed the demon. “They’ve already been debunked well enough. They won’t even exist in 2021 – even I am willing to grant they’ve got that much intelligence!”

“OK”, said the angel. “Dollars it is then.”

Updates

Mostly written at the beginning of 2022, this post was published on 2022-03-05 but has had various small edits and updates since then to keep it relevant and correct.